... how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions (...)? And how do we factor that assessment into monetary policy? We as central bankers need not be concerned if a collapsing financial asset bubble does not threaten to impair the real economy, its production, jobs, and price stability. Indeed, the sharp stock market break of 1987 had few negative consequences for the economy. But we should not underestimate or become complacent about the complexity of the interactions of asset markets and the economy. Thus, evaluating shifts in balance sheets generally, and in asset prices particularly, must be an integral part of the development of monetary policy.

Alan Greenspan, 1996

While seemingly dull, Greenspan’s admonitory words underscore a highly interesting issue pertinent to the financial markets: The influence and dynamics of irrational behavior, bias and emotion on price developments, as described by behavioral economics.

Greenspans’ legendary phrase “irrational exuberance” refers to investor enthusiasm that drives asset prices higher than those assets’ fundamentals justify. When investors start believing that the rise in prices in the recent past predicts the future, they are acting as if there is no uncertainty in the market, causing a positive feedback loop of ever-higher prices, resulting in a speculative bubble, frenzy even, eventually bound to burst. The bursting of these bubbles inevitably leads to the next irrational behavior, i.e. panic selling, which—if spreading to other asset classes—can eventually cause a recession. In his speech, Alan Greenspan raises the question of whether central banks should address irrational exuberance via a preemptive tight monetary policy. He believed that central should raise interest rates when it appears that a speculative bubble is beginning to take shape, but failed to do so in time in the run-up of the Dotcom-crash in 2000/2001.

The irony of the phrase and its aftermath lies in Greenspan’s widely held reputation as the most artful practitioner of “Fedspeak,” often known as “Greenspeak.” Greenspan’s idea was to obfuscate his true opinion in long complex sentences with obscure words so as to intentionally mute any strong market response. Precisely because he was considered to be so good at this, an uncharacteristically clear statement such as “irrational exuberance” was viewed as a strong signal to the markets and its meaning was widely discussed by financial journalists at the time of the speech. The further irony was that if it was indeed his intended purpose to “talk markets down” he was later ignored as stock valuations three years later dwarfed the levels at the time of the speech.

Behavioral economist Robert J. Shiller writes: Irrational exuberance is the psychological basis of a speculative bubble. I define a speculative bubble as a situation in which news of price increases spurs investor enthusiasm, which spreads by psychological contagion from person to person, in the process amplifying stories that might justify the price increases, and bringing in a larger and larger class of investors who, despite doubts about the real value of an investment, are drawn to it partly by envy of others’ successes and partly through a gamblers’ excitement.

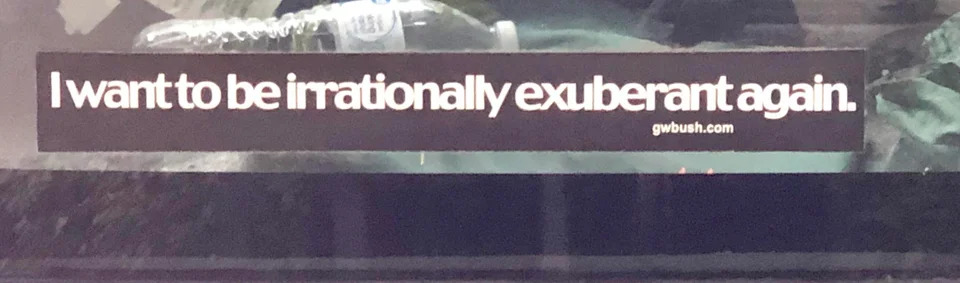

Bumper sticker seen in the wake of the dot-com crash around Silicon Valley

Sources:

- Shiller, Robert J., Irrational Exuberance, Princeton University Press, Princeton, 2000 (pdf)

- “The Challenge of Central Banking in a Democratic Society.” Remarks by Chairman Alan Greenspan at the Annual Dinner and Francis Boyer Lecture of The American Enterprise Institute for Public Policy Research, Washington, D.C., December 5, 1996 (The Federal Reserve)

- Irrational Exuberance (Investopedia)

- Irrational Exuberance (Wikipedia)